Summary

The newly initiated scheme concerning Section 128A is aimed at providing benefits related to interest and penalties for taxpayers.

Highlights

📝 Consult Professionals: It is crucial to consult with tax advisors before filing to understand the benefits and avoid mistakes.

🚫 Risk of Rejection: Applications filed without proper knowledge may be rejected, leading to further complications.

⏰ Strict Deadlines: No extensions or waivers will be granted; adhere strictly to the outlined timelines.

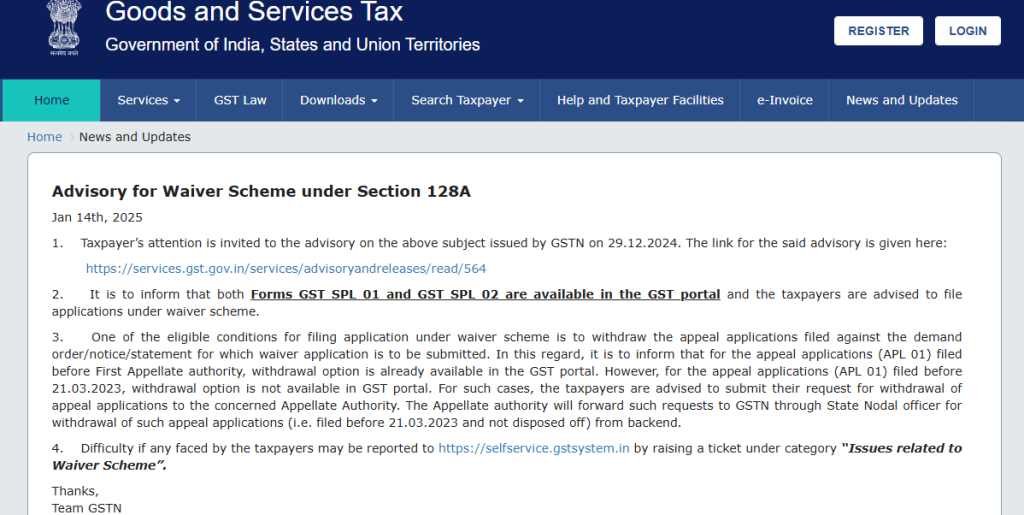

📅 Withdrawal Restrictions: Appeals filed before March 21, 2023, cannot be withdrawn under the new amnesty scheme.

⚖️ Importance of Clarity: Understanding the advisory issued by GST is essential for a smooth filing process.

FILING PROCESS OF SPL-02: https://tutorial.gst.gov.in/downloads/news/help_document_on_filing_of_spl_02.pdf

Key Insights

📊 GST Compliance: The importance of compliance with GST regulations cannot be overstated. Non-compliance can lead to severe penalties, making it imperative for taxpayers to understand the implications of their actions.

📅 Section 128A Benefits: Section 128A offers significant benefits for interest and penalties, but taxpayers must be aware of the specifics to take full advantage of it. The complexity of the rules necessitates professional guidance.

⚠️ Risks of Incorrect Filing: Incorrectly filed applications can lead to rejection. Hence, thorough understanding and adherence to the guidelines are critical to successful filing.

🔄 Appeal Withdrawal Nuances: The inability to withdraw appeals filed before a certain date can limit options for taxpayers seeking to benefit from the new scheme. This restriction highlights the importance of timely decision-making in tax matters.

🗓️ Timeliness in Action: The strict deadlines emphasize that procrastination can lead to missed opportunities in availing benefits under the GST framework.

FAQs

Q1: What is Section 128A of the GST Act?

A1: Section 128A provides taxpayers with benefits related to interest and penalties under specific conditions.

Q2: How can I ensure my GST application is filed correctly?

A2: It is advisable to consult with a tax professional or consultant who can guide you through the filing process to avoid errors.

Q3: What happens if my GST application gets rejected?

A3: A rejected application can lead to complications, and it is essential to understand the reasons for rejection to avoid future issues.

Q4: Are there any extensions available for filing under the new GST scheme?

A4: No extensions will be granted; it is crucial to adhere to the specified deadlines.

Core Concepts

GST Compliance: The importance of adherence to GST regulations is fundamental to avoid penalties and ensure a smooth filing process. Taxpayers must stay informed about the rules and guidelines that govern their obligations under GST.

Professional Guidance: Navigating the complexities of GST benefits and filing processes can be challenging. Engaging with tax professionals can provide clarity and assist in maximizing available benefits, especially under schemes like Section 128A.

Timeliness and Accuracy: Filing applications accurately and within stipulated timelines is crucial. The strict deadlines associated with the new schemes underscore the need for timely action to secure benefits and avoid complications.

Understanding the Amnesty Scheme: The amnesty scheme under Section 128A provides unique opportunities for taxpayers. However, understanding the specific conditions and restrictions is essential for those looking to take advantage of these benefits.

Education and Resources: Continuous education about the GST framework is vital for compliance. Utilizing available resources, such as courses and mobile applications, can empower taxpayers to manage their obligations effectively.

GST FULL COURSE 2025 LIVE BATCH –https://web.gstplatform.com/courses

Also read our other related articles:https://gstplatform.com/gst-return-new-advisory-for-jan-2025/