Income Tax Update: No Tax on Income Up to ₹12 Lakh for FY 2024-25 & 2025-26

A major update in India’s income tax structure has brought relief and clarity to many taxpayers:

Incomes up to ₹12 lakh will now be tax-free for the financial years 2024-25 and 2025-26. This significant change aims to simplify tax calculations, especially when filing Income Tax Returns (ITR) due on July 31, 2025, and July 31, 2026. In this post, we’ll break down how to calculate your income tax, understand the latest tax slabs, and effectively use the new tax calculator introduced by the government.

Understanding the New Tax Regime

Key Features of the New Tax Regime

The new tax regime eliminates tax liability for individuals earning up to ₹12 lakh. This has created excitement among taxpayers, particularly salaried professionals, but also some confusion regarding its application in actual tax calculations.

What is the Income Tax Calculator?

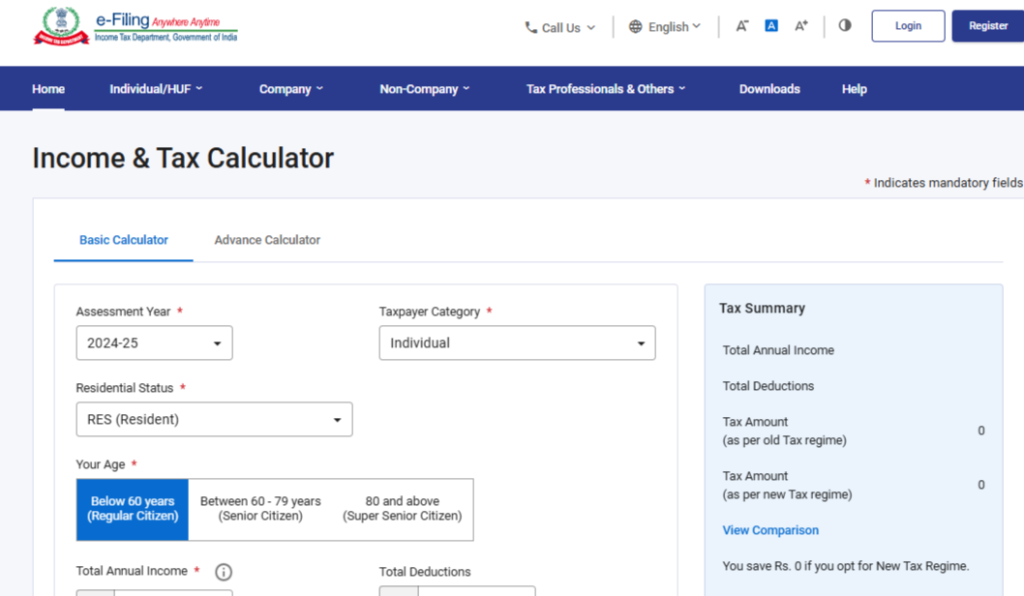

To help taxpayers understand their tax liability better, the government has introduced a free Income Tax Calculator. This tool allows users to compare their tax liabilities under both the old and new tax regimes.

To access it, visit incometax.gov.in

How to Use the Income Tax Calculator

- Visit the Calculator – Go to the official income tax website.

- Select Assessment Year – Choose FY 2024-25 or FY 2025-26.

- Enter Your Details – Input your total income and applicable deductions.

- Review the Results – The calculator will display your tax liability under both regimes, helping you determine the best option.

Tax Slabs for FY 2024-25 and FY 2025-26

Financial Year 2024-25

| Income Slab | Tax Rate |

|---|---|

| Up to ₹3 lakh | No tax |

| ₹3 lakh – ₹6 lakh | 5% |

| ₹6 lakh – ₹12 lakh | 10% |

| Above ₹12 lakh | 20% |

Individuals earning below ₹7 lakh get full tax relief through rebate under Section 87A, effectively making their tax liability zero.

Financial Year 2025-26

| Income Slab | Tax Rate |

| Up to ₹4 lakh | No tax |

| ₹4 lakh – ₹8 lakh | 5% |

| ₹8 lakh – ₹12 lakh | 10% |

| Above ₹12 lakh | 20% |

Example: Tax Calculation for an Individual Earning ₹13,25,000

Taxable Income: ₹13,25,000

| Income Range | Tax Rate | Tax Amount |

| Up to ₹4 lakh | No tax | ₹0 |

| ₹4 lakh – ₹8 lakh | 5% | ₹20,000 |

| ₹8 lakh – ₹12 lakh | 10% | ₹40,000 |

| Above ₹12 lakh (₹1,25,000) | 20% | ₹25,000 |

Gross Tax Payable: ₹85,000

Education Cess (4%): ₹3,400

Total Tax Payable: ₹88,400

Importance of Deductions

Deductions can significantly reduce taxable income, but most are not available under the new regime. Understanding which deductions apply is crucial.

Common Deductions Under the Old Regime

- Section 80C – Up to ₹1.5 lakh (PPF, ELSS, NSC, etc.)

- Section 80D – Health insurance premiums

- Standard Deduction – ₹50,000 for salaried and pensioners

Last-Minute Tax Planning Tips

- Plan Early – Estimate your taxable income and plan for deductions or tax-saving investments in advance.

- Evaluate the Old vs. New Regime – If your deductions significantly reduce taxable income, the old regime might still be beneficial.

- Stay Updated – Tax laws frequently change, so always stay informed.

Conclusion

Understanding the new income tax framework for FY 2024-25 and FY 2025-26 will help you make smarter financial decisions. Using the government’s Income Tax Calculator ensures you select the most tax-efficient option based on your financial profile.

Assess your income, deductions, and tax slabs carefully to navigate this new system effectively. Proper planning can lead to significant savings in the long run!

📢 Found this helpful? Subscribe for more tax updates and financial planning tips. Don’t forget to share this article with your friends and family so they can also benefit from these important changes! 🔔

GST FULL COURSE 2025 LIVE BATCH – GST FULL COURSE 2025

Also read our other related articles– https://gstplatform.com/new-billing-rule-from-april-2025/