Summary

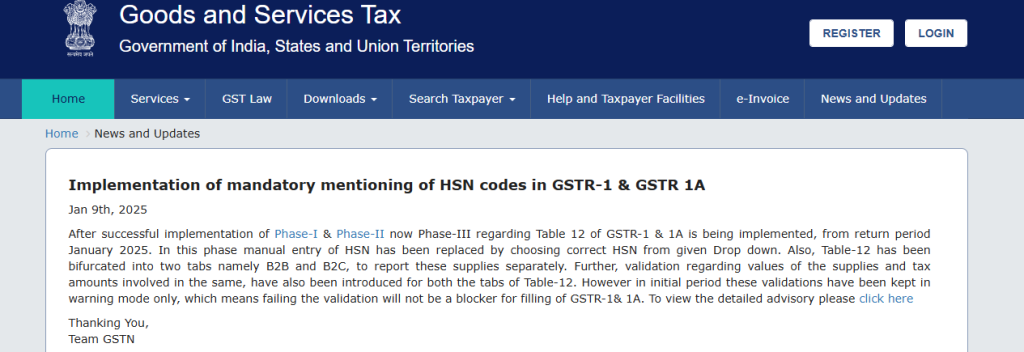

There is a significant changes to Table 12 of the GST Return (GSTR-1) that will take effect from January 2025. The changes primarily focus on the handling of HSN (Harmonized System of Nomenclature) level data, which now must be submitted separately for B2B (business-to-business) and B2C (business-to-consumer) transactions. This restructuring aims to improve the accuracy of GST filing and compliance. The businesses must now provide detailed HSN data based on their turnover, introducing new validation processes that will ensure the accuracy of the reported figures.

FOR ADVISORY COPY CLICK HERE-https://tutorial.gst.gov.in/downloads/news/advisory_on_hsn_validation_08_01_25.pdf

Highlights

📅 New Rules from January 2025: The GSTR-1 Table 12 will have critical changes starting January 2025.

📊 Separate Reporting for B2B and B2C: HSN data must be reported separately for B2B and B2C transactions.

🔍 Mandatory HSN Data: Businesses must provide four-digit HSN codes for turnover up to ₹5 crores and six-digit codes for amounts exceeding that.

⚖️ Validation Process Enhancements: A new validation system will check that reported HSN data matches sales figures in other tables.

💻 Downloadable HSN Code List: A new feature allows taxpayers to download an updated list of HSN codes in Excel format for ease of filing.

❗ Warning System for Discrepancies: Initial discrepancies will result in a warning, but future filings may be blocked if issues are not resolved.

Key Insights

📌 Impact of HSN Reporting Changes: The separation of HSN reporting for B2B and B2C transactions is a significant shift that will require businesses to be diligent in their record-keeping and compliance efforts. This could lead to better data accuracy for tax authorities.

📌 Turnover-Based Reporting Requirements: The differing HSN reporting requirements based on turnover levels indicate a tailored approach to compliance, allowing smaller businesses some leeway while ensuring larger entities provide detailed information.

📌 Automated Systems for Accuracy: The introduction of drop-down menus for HSN codes and automatic population of descriptions signifies a move toward reducing human error in tax filing, which could streamline the process for many businesses.

📌 Validation Checks are Crucial: The validation checks between different tables within GSTR-1 provide an additional layer of accountability, ensuring that reported sales figures align with HSN data, thereby preventing discrepancies.

📌 Warning System as a Compliance Tool: The initial warning system for mismatches serves both as a cautionary measure and a learning tool, allowing taxpayers to correct errors before facing more severe repercussions in the future.

FAQs

Q1: What changes are coming to GSTR-1 Table 12 in January 2025?

A1: Starting January 2025, GSTR-1 Table 12 will require separate reporting of HSN data for B2B and B2C transactions.

Q2: Do small businesses need to report HSN data?

A2: Yes, if their turnover exceeds ₹5 crores, they must report HSN data using six-digit codes; otherwise, four-digit codes are mandatory for lower turnovers.

Q3: What happens if there is a discrepancy in reported HSN data?

A3: Initially, discrepancies will result in a warning, allowing businesses to rectify errors. Continued mismatches could lead to filing restrictions.

Q4: How can I access the updated HSN code list?

A4: Taxpayers can download an Excel file of the updated HSN code list directly from Table 12 in the GSTR-1 filing portal.

Q5: Where can I find more information about the changes?

A5: For more detailed information, please visit the GST platform website or consider enrolling in their GST course for comprehensive education.

Core Concepts

GST Compliance and Reporting Changes: The video outlines essential changes to GST reporting, particularly focusing on how businesses will need to revise their approach to HSN data submission. The clear distinction between B2B and B2C reporting requirements signifies a stricter regulatory framework aimed at enhancing compliance and reducing tax evasion.

Data Accuracy and Validation: The introduction of validation checks emphasizes the importance of accuracy in tax filings. By ensuring that reported sales figures align with HSN data, the GST framework aims to create a more reliable system that benefits both the government and compliant businesses.

Support for Taxpayers: The video highlights the importance of resources available to taxpayers, such as downloadable HSN lists and automated features in the filing portal. These tools are designed to ease the filing process and support businesses, particularly those that may struggle with complicated tax regulations.

For Continuous Learning: Stay updated with GST laws and regulations and further education through our courses to better understand compliance requirements.

GST FULL COURSE 2025 LIVE BATCH –https://web.gstplatform.com/courses

Also read our other related articles: https://gstplatform.com/section-164-rectification-application/