GSTR-3B Filing Updates: Key Changes Effective February 2025-NEGATIVE LIABILITY

In the dynamic landscape of Goods and Services Tax (GST) compliance, staying updated with the latest amendments is crucial for businesses and tax professionals. One of the most significant updates as of February 2025 pertains to the GSTR-3B form, a pivotal return for monthly GST filings. This article explores the key modifications in GSTR-3B, particularly the newly introduced functionality for reporting negative figures.

Understanding GSTR-3B

GSTR-3B is a simplified GST return introduced to ease compliance for taxpayers. It provides a summary of outward supplies, input tax credit (ITC) claims, and tax liability. Over time, changes have been made to streamline its usability, with the latest update addressing long-standing challenges related to reporting negative values.

Key Changes Effective February 2025

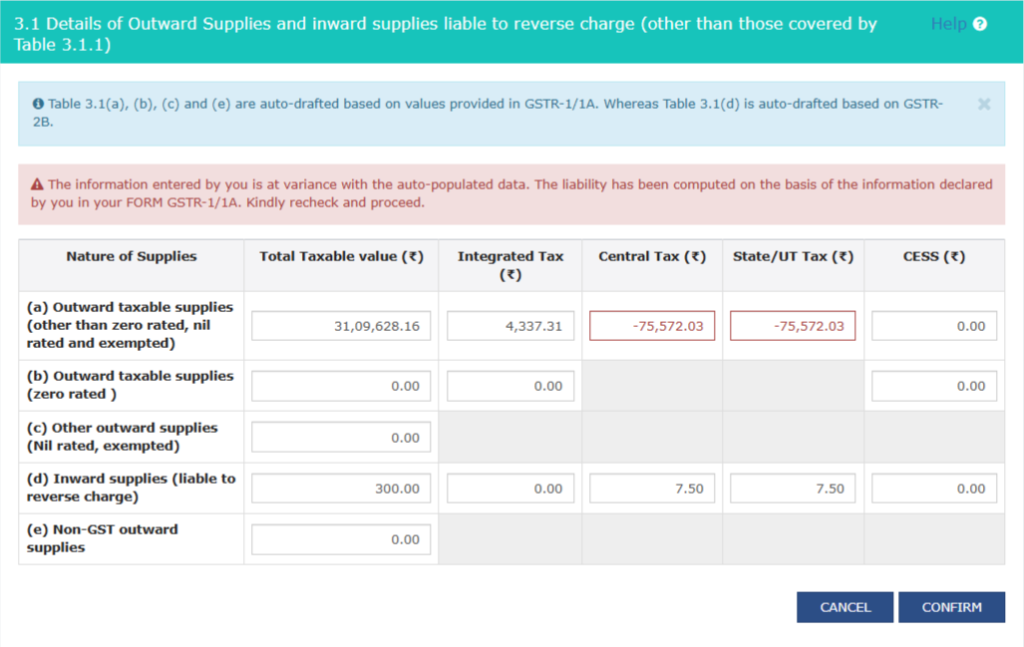

On February 14, 2025, a critical amendment was made to Table 3.1 of GSTR-3B, allowing taxpayers to enter negative figures directly in their monthly returns.

New Option to Report Negative Figures

Previously, taxpayers faced hurdles when their sales returns or credit notes exceeded their total sales for a given month. This often resulted in cumbersome adjustments and reconciliation challenges. With the new update, taxpayers can now report negative values, ensuring:

1) Accurate taxable supply reporting: Net tax liability calculations become more precise, reflecting the true nature of business transactions.

2) Simplified compliance: The process of adjusting excess sales returns or credit notes is more straightforward.

3) Legal alignment: Businesses can ensure compliance by appropriately reflecting all transactions without workarounds.

A Closer Look at Table 3.1 Changes

Table 3.1 in GSTR-3B, which details tax on outward supplies and reverse charge transactions, now accommodates negative adjustments. The key takeaways include:

* Taxpayers can net off taxable sales against credit notes and sales returns.

* Inter-state supplies and ITC adjustments remain editable before submission.

* Automated locking of figures is expected in future updates to reduce manual errors.

Implications on ITC and Taxable Value Reporting

1. Taxable Value Calculation

* Businesses should net their sales figures after adjusting for credit and debit notes.

* Example: If sales are ₹1,00,000, credit notes total ₹20,000, and debit notes are ₹10,000, the reported taxable value should be ₹90,000.

2. Reversal of ITC Adjustments

* When reporting negative figures, businesses should also review their claimed ITC to ensure proper reversals where necessary.

* Incorrect ITC claims could result in notices or penalties from tax authorities.

Filing Considerations for Businesses

To ensure seamless compliance with these changes, businesses must:

* Validate data accuracy before submission, as the system may auto-populate figures from GSTR-1 and GSTR-2.

* Prepare for upcoming automation, where future filings may see increased integration and limited manual adjustments.

* Seek professional guidance to navigate these amendments effectively, ensuring compliance and avoiding errors.

How This Affects Your Business

With these changes, businesses can expect:

* Improved accuracy in tax reporting, reducing reconciliation challenges.

* Lower compliance burdens, as negative figures can now be reported directly.

* Better readiness for audits, ensuring all data aligns with actual transactions.

Final Thoughts

The amendments to GSTR-3B mark a significant step towards a more transparent and efficient GST compliance framework. Taxpayers should embrace these updates to ensure accurate reporting, minimize compliance risks, and enhance financial accuracy.

Stay ahead by sharing this information with peers and colleagues. For further guidance, consult a GST expert or visit our platform for the latest GST compliance updates.

GST FULL COURSE 2025 LIVE BATCH – https://web.gstplatform.com/courses

Also read our other related articles– GST CHECKLIST BEFORE MARCH 2025