Summary

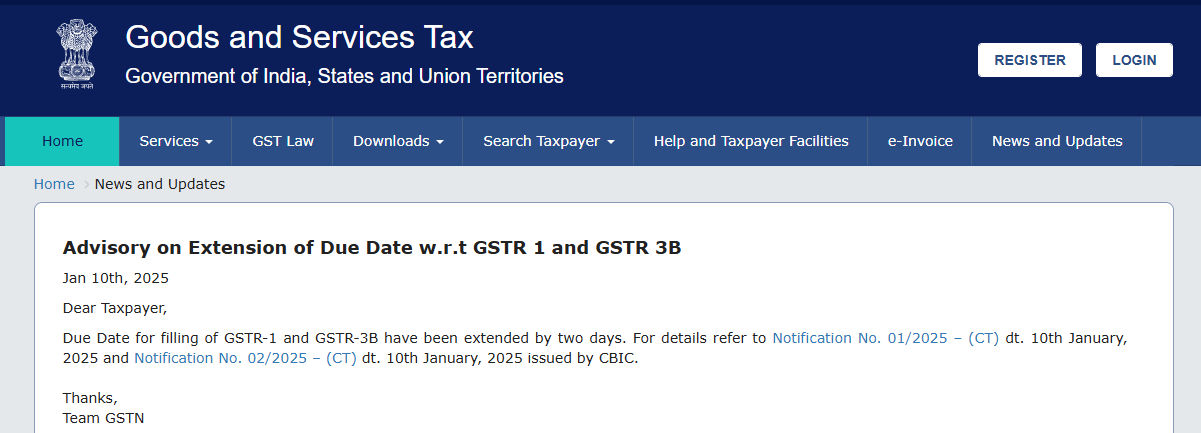

Date extension for GSTR3B. The confusion arises from the extension of the due date for GSTR1, which subsequently affects the timeline for generating GSTR2B. The new filing deadlines for both monthly and quarterly taxpayers, and the implications of these changes on the input tax credit and return submissions. Detailed timelines are provided, along with the importance of updating the Invoice Management System (IMS) prior to filing GST R3B to avoid errors.

For Notification No. 01/2025 Click Here: https://tutorial.gst.gov.in/downloads/news/notification_no_012025.pdf

For Notification No. 02/2025 Click Here: https://tutorial.gst.gov.in/downloads/news/notification_no_022025.pdf

Highlights

📅 Due dates for GST R3B filings have been extended, affecting all taxpayers.

📊 Monthly filers can now file GSTR-3B until January 22, 2025 .

🗓️ Quarterly taxpayers have an extended deadline until January 26, 2025.

🔄 The generation of GSTR2B will occur on January 16, 2025, after GST R1 filing.

⚙️ The Invoice Management System (IMS) must be updated before filing to prevent errors.

Key Insights

📅 Understanding Deadline Extensions: The extension of the due dates for GST R3B filing is critical for both monthly and quarterly filers. Knowing these dates allows taxpayers to avoid late fees and potential errors in submission.

📊 Impact on Monthly and Quarterly Filers: Monthly filers now have a total of 7 days for filing, while quarterly filers receive an additional 9 to 11 days, giving them a buffer to prepare their returns adequately.

🔄 Generation of GSTR2B: The timeline for the generation of GST R2B is tied directly to the filing deadline of GSTR1. Taxpayers must be aware that GSTR2B will only be generated after the filing of the GSTR1, affecting their ability to claim input tax credits timely.

⚙️ Importance of IMS Updates: Checking the IMS after January 15, 2025, to ensure that any changes or updates are reflected accurately before filing GST R3B.

⚠️ Potential for Errors: The risks of filing without proper updates from the IMS, emphasizing that this could lead to filing errors and complications with GST compliance.

FAQs

Q1: What is the new deadline for monthly GST R3B filers?

A1: The new deadline for monthly filers is January 22, 2025.

Q2: When will GSTR2B be generated for December 2024?

A2: GSTR2B will be generated on January 16, 2025.

Q3: How can I avoid errors in GST filing?

A3: Ensure you update the Invoice Management System (IMS) after January 15, 2025, before filing your GST R3B.

Q4: What resources are available for understanding GST compliance?

A4: A comprehensive GST course starting on January 18, 2025, is available for those seeking in-depth knowledge.

Core Concepts

The core concepts of the content revolve around the recent updates in the GST filing process. The confusion that arose from the extension of the GST R1 filing deadline and how this impacts the timeline for GSTR2B generation. The new due dates for both monthly and quarterly filers, emphasizing the need for awareness among taxpayers to avoid penalties and filing errors.

For Continuous Learning: Stay updated with GST laws and regulations and further education through our courses to better understand compliance requirements.

GST FULL COURSE 2025 LIVE BATCH –https://web.gstplatform.com/courses

Also read our other related articles:https://gstplatform.com/implementation-of-mandatory-hsn-code-for-gstr1-gstr1a/